What Is Singapore’s Personal Income Tax Rate? A Complete Guide for 2025

Singapore stands out as a leading financial hub in the region, governed by the Inland Revenue Authority of Singapore (IRAS). It continues to attract foreign investors with its pro-business tax regime. Beyond investment opportunities, it is also an appealing destination for professionals. Singapore offers a highly competitive tax environment with one of the lowest personal income tax rates globally.

This guide provides a comprehensive overview of Singapore’s personal income tax system for 2025.

Singapore continues to be a premier financial hub in the region, governed by the Inland Revenue Authority of Singapore (IRAS). Its pro-business tax regime not only attracts foreign investors but also makes it an appealing destination for professionals. Singapore offers a highly competitive tax environment with one of the lowest personal income tax rates globally.

This guide provides a comprehensive overview of Singapore’s personal income tax system for the Year of Assessment (YA) 2025

Who Is Required to Pay Personal Income Tax in Singapore?

Anyone who earns, derives, or receives income in Singapore will need to pay Singapore income tax every year, unless specifically exempted under the Income Tax Act or by an Administrative Concession. An individual’s tax liability is determined by their tax residency status and the amount of taxable income, with progressive tax rates applied accordingly. All individuals with an annual income of S$22,000 or more must file their income tax returns with IRAS.

What are the Personal Income Tax Rates for Residents?

The tax liability of an individual depends on the individual’s tax residency status and Singapore tax rate. He or she will be treated as a tax resident for a particular Year of Assessment (YA) if they are a:

- Singapore Citizen (except for temporary absences)

- Singapore Permanent Resident (SPR) who stays in Singapore with a permanent home; or

- A foreigner who has resided/worked in Singapore (excluding a company director) for 183 days or more in the previous year. i.e. the year before the YA.

Otherwise, the individual is treated as a non-resident for tax purposes.

From the Year of Assessment (YA) 2024 onwards, the top marginal personal income tax rates have been increased to promote greater progressivity. Income exceeding S$500,000 up to S$1 million is taxed at 23%, while income above S$1 million is taxed at 24%. These rates remain in effect for the Year of Assessment 2025.

The updated tax rates for YA 2025 are as follows:

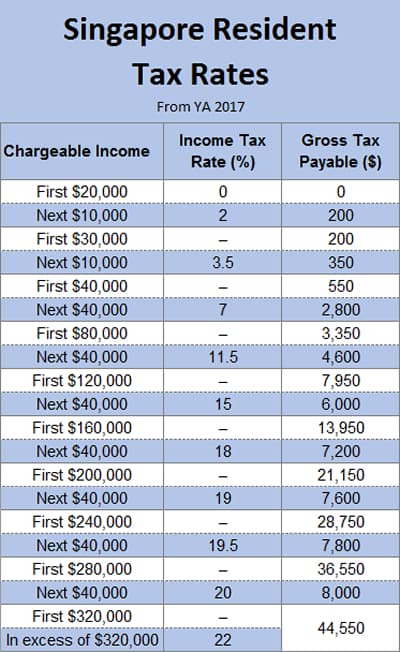

Singapore Resident Tax Rates

From YA 2024 onwards

| Chargeable Income | Income Tax Rate (%) | Gross Tax Payable ($) |

| First $20,000 Next $10,000 |

0 2 |

0 200 |

| First $30,000 Next $10,000 |

– 3.50 |

200 350 |

| First $40,000 Next $40,000 |

– 7 |

550 2,800 |

| First $80,000 Next $40,000 |

– 11.5 |

3,350 4,600 |

| First $120,000 Next $40,000 |

– 15 |

7,950 6,000 |

| First $160,000 Next $40,000 |

– 18 |

13,950 7,200 |

| First $200,000 Next $40,000 |

– 19 |

21,150 7,600 |

| First $240,000 Next $40,000 |

– 19.5 |

28,750 7,800 |

| First $280,000 Next $40,000 |

– 20 |

36,550 8,000 |

| First $320,000 In excess of $320,000 |

– 22 |

44,550 |

| First $320,000 Next $180,000 |

– 22 |

44,550 39,600 |

| First $500,000 Next $500,000 |

– 23 |

84,150 115,000 |

| First $1,000,000 In excess of $1,000,000 |

– 24 |

199,150 |

What are the Personal Income Tax Rates for Non-Residents?

Non-residents are individuals who have stayed or worked in Singapore for less than 183 days in a calendar year. They are taxed only on income earned in Singapore and do not qualify for tax reliefs or resident tax benefits.

-

- Taxes on employment income: Employment income for non-residents is taxed at either a flat rate of 15% or at the progressive resident tax rates, whichever results in a higher tax amount.

- Taxes on directors’ fees, consultation fees and all other income: This is currently taxed at a rate of 24%, effective from the Year of Assessment (YA) 2024. This rate increase, up from 22%, aims to align non-resident income tax rates with the top marginal rate for residents.

- Non-resident public entertainers are taxed at a flat rate of 10%.

Withholding Taxes on Income of Non-Resident Individuals

Non-resident individuals are subject to withholding tax on specific types of income when the income becomes due or payable. The applicable withholding tax rates vary depending on the nature of the income and the relevant Year of Assessment (YA).

Withholding Tax Rates for Non-Resident Individuals (Effective YA 2025)

| Income Type | Withholding Tax Rate from YA 2024 Onwards | Withholding Tax Rate from YA 2017 to YA 2023 |

| Director’s Fees (Non-Resident Director) | 24% | 22% |

| Professional Services (Non-Resident Professionals) | – 15% on gross income

– 24% on net income (if elected) |

– 15% on gross income

– 22% on net income (if elected) |

| Public Entertainers (Non-Resident) | 15% | – 10% (up to 31 Mar 2022)

– 15% (from 1 Apr 2022 |

| Supplementary Retirement Scheme (SRS) Withdrawals (Non-Singaporean) | 24% | 22% |

| Interest, Commission, Fees, or Payments Related to Loans or Indebtedness | – 15% (if conditions for reduced rate are met)

– 24% (if conditions are not met) |

– 15% (if conditions for reduced rate are met)

– 22% (if conditions are not met) |

| Royalties or Lump Sum Payments for Use of Movable Properties | – 10% (if conditions for reduced rate are met)

– 24% (if conditions are not met) |

– 10% (if conditions for reduced rate are met)

– 22% (if conditions are not met) |

Differences in Income Tax Rates: Residents vs. Non-Residents

| Category | Tax Residents | Non-Tax Residents |

| Definition | Singapore Citizens or Permanent Residents residing in Singapore, except for temporary absences.

– Foreigners who have stayed or worked in Singapore for at least 183 days in the previous calendar year. |

Individuals who do not meet the criteria for tax residency, i.e., stayed or worked in Singapore for less than 183 days in the previous calendar year. |

| Income Subject to Tax | All income earned in Singapore.

– Foreign-sourced income received in Singapore, unless exempted. |

Only income earned in Singapore is taxable. |

| Tax Rates | Progressive tax rates ranging from 0% to 24%, depending on chargeable income. Typically results in lower effective tax rates for most income levels compared to the flat rates applied to non-residents. | Generally, it is subject to a flat income tax rate of 24% on most types of income. Employment income is taxed at 15% or resident rates, whichever results in a higher tax amount. Some other income types may also qualify for a reduced withholding tax rate. |

| Personal Reliefs | Eligible for various personal reliefs, rebates, and deductions, reducing taxable income. | Not eligible for personal reliefs or rebates. |

| Tax Filing | Required to file annual tax returns if income exceeds S$22,000. | Required to file annual tax returns if they have income taxable in Singapore. |

| Tax Advantages | Potentially lower tax liability due to progressive rates and eligibility for reliefs.

– Access to tax treaties and credits. |

Higher tax rates on certain income types.

– Limited access to tax treaties and credits. |

Are There Any Tax Rebates for YA 2025?

As part of the SG60 initiative to share the benefits of the nation’s progress, a Personal Income Tax rebate will be granted to all tax resident individuals for the Year of Assessment (YA) 2025, based on income earned in 2024. Eligible taxpayers will receive a rebate of 60% of their tax payable, capped at S$200 per individual.

Amount of tax rebate:

| Year of Assessment | Amount of tax rebate |

| 2025

2024 |

60% of tax payable, up to $200

50% of tax payable, up to $200 |

How 3E Accounting Can Help?

Navigating personal income tax obligations in Singapore can be complex without proper guidance. If you’re unsure about how to file your taxes or need assistance understanding your tax responsibilities, it’s advisable to seek expert support.

3E Accounting offers comprehensive and reliable tax advisory services tailored to both residents and non-residents. Feel free to reach out to their team of professionals to ensure accurate and compliant tax filing.

Related Links

- Singapore Personal Income Tax Guide

- Singapore Personal Income Tax Calculator

- Personal Income Tax Filing Season for Year 2017

- Personal Income Tax Planning

- Personal Tax Reliefs in Singapore