This post is also available in:

简体中文 (Chinese (Simplified))

Overview of Goods and Services Tax (GST) in Singapore

GST Rate Hike

In view of the impending increase in the GST rate from 7% to 8% from 1 January 2023 and subsequently to 9% from 1 January 2024, GST registered businesses are strongly encouraged to start preparation early for a smooth transition to the new GST rate(s). Kindly note that GST transitional rules applicable to supplies which span the change of GST rate include the reissuance of unpaid invoices over the transition period to account for GST at the new rate.

GST Registration

All Singapore companies must register for GST if their annual taxable revenue is more than S$1 million, or if their current taxable income and annual taxable revenue is expected to be more than S$1 million. The business must register for GST within thirty days from the time it is deemed liable.

You may also choose to voluntarily register for GST. Approval for voluntary registration is at the discretion of the IRAS Comptroller. Once approval is given, you must remain registered for at least two years.

You may refer to Should I registered GST for my Company for more GST meaning information.

Charging and Collecting GST

Once you have registered for GST, you must charge GST on your supplies at the prevailing rate. This GST that is charged and collected is known as output tax. Output tax must be paid to IRAS.

The GST that you incur on business purchases and expenses (including import of goods) is known as input tax. If your business satisfies the conditions for claiming input tax, you can claim the input tax on your business purchases and expenses.

This input tax credit mechanism ensures that only the value added is taxed at each stage of a supply chain.

Type of Supplies

Generally, there is 4 types of supplies in Singapore

Standard-Rated Supplies (8% * GST)

Most local sales of goods and services fall under this category.

Zero-Rated Supplies (0% GST)

Export of goods and Services that are classified as international services

Exempt Supplies (GST is not applicable)

– Sale and rental of unfurnished residential property

– Importation and local supply of investment precious metals

– Financial services

Out-of-Scope Supplies (GST is not applicable)

– Sale where goods are delivered from overseas to another place overseas

– Private transactions

* A 2% rate hike from 7% to 9% is planned to be introduced sometime between 2021 and 2025, depending on Singapore’s economy, government spending and revenue from other taxes.

Time of Supply Rules Effective 1 Jan 2011

With effect from 1 Jan 2011, For most transactions, output tax will be accounted for based on the earlier of the following:

- When an invoice is issued

- When payment is received

Conditions for Claiming Input Tax

You must satisfy these conditions to claim input tax:

- You are GST-registered;

- The goods or services must have been supplied to you or the goods have been imported by you;

- The goods or services are used or will be used for the purpose of your business;

- Local purchases must be supported by valid tax invoicesaddressed to you, or simplified tax invoices at the time of claiming the input tax;

- Imports must be supported by import permits which show you as the importer of the goods;

- The input tax is directly attributable to taxable supplies (i.e. standard-rated supplies and zero-rated supplies), or out-of-scope supplies which would be taxable supplies if made in Singapore;

- The input tax claims are not disallowed under Regulations 26 and 27 of the GST (General) Regulations.

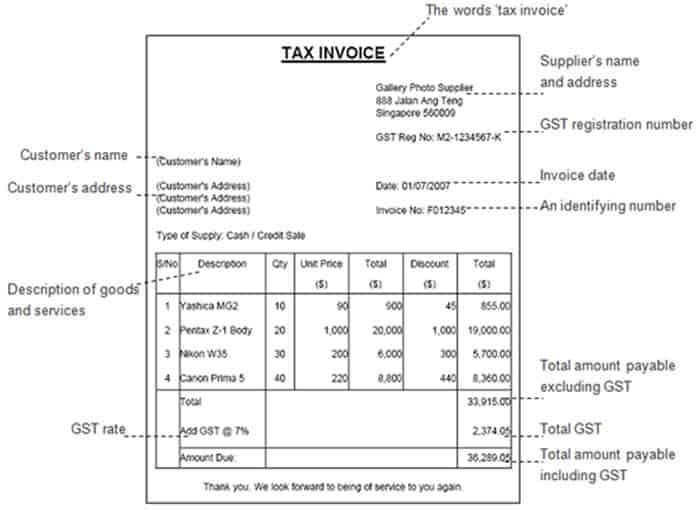

Tax Invoice

A tax invoice is the main document for supporting an input tax claim.

You must keep the tax invoices issued to your customers, and those given to you by your suppliers, for at least five years. You do not need to submit these tax invoices with your GST returns.

A tax invoice must be issued when your customer is GST registered. Your customer needs to keep this tax invoice as a supporting document to claim input tax on his standard-rated purchases. In general, a tax invoice should be issued within 30 days from the time of supply.

A tax invoice need not be issued for zero-rated supplies, exempt supplies and deemed supplies or to a non-GST registered customer.

Your tax invoice must also provide details on exempt, zero-rated, or other supplies, if applicable. The gross amount payable for each type of supply must also be separately stated.

A typical tax invoice is shown below with the required information indicated:

Disallowed Input Tax Claims

Regulations 26 and 27 of the GST (General) Regulations do not allow the following expenses to be claimed as input tax:

- Benefits provided to the family members or relatives of your staff;

- Costs and running expenses incurred on private registered motor cars;

- Club subscription fees (including transfer fees) charged by sports and recreation clubs;

- Expenses incurred on company cars of which the COE has been renewed or extended on or after 1 Apr 1998;

- Expenses incurred on rental cars hired for use on or after 1 Jul 1999;

- Medical expenses incurred for your staff unless they are obligatory under the Work Injury Compensation Act or under any collective agreement within the meaning of the Industrial Relations Act;

- Medical and accident insurance premiums incurred for your staff unless the insurance or payment of compensation is obligatory under the Work Injury Compensation Act or under any collective agreement within the meaning of the Industrial Relations Act; and

- Any transaction involving betting, sweepstakes, lotteries, fruit machines or games of chance.

Expenses Incurred by Employee on Behalf of the Company

Generally, you are not allowed to claim input tax for purchases if the tax invoices are not addressed to your company name.

However, input tax claims can be allowed if you can prove that your employee is acting as an agent of your company (i.e. the taxable person) in receiving the supply of goods or services.

For example, you should maintain evidence of reimbursements made to the employee and recognise the bills as business expenses in your accounts.

Please note that your input tax claims are also subject to the following conditions:

- You are a GST-registered business;

- The goods or services are used or to be used for the purpose of your business;

- The input tax is directly attributable to taxable supplies or out-of-scope supplies which would be taxable if made in Singapore; and

- The input tax claims are not disallowed expenses under Regulations 26 and 27 of the GST (General) Regulations.

GST Online E-learning Courses

For voluntary registration, company director / sole-proprietor/ partner/ trustee must complete two e-Learning courses – “Registering for GST” and “Overview of GST” – and pass the quiz.

You are advisable to go through both courses to better understand the Singapore GST system.

GST update – Customer Accounting for Prescribed Goods

From 1 January 2019, customer accounting is required to be applied on a relevant supply of prescribed goods made to a GST-registered customer for his business purpose. The prescribed goods are mobile phones, memory cards and off-the-shelf software, which are commonly used in these fraud schemes. Continue reading

GST on imported services

GST will be introduced on imported services on or after 1 January 2020.

Taxing Business-to-Business (“B2B”) imported services by way of reverse charge

If you are either:

- a GST-registered partially exempt business that is not entitled to full input tax credit; or

- a GST-registered charity or voluntary welfare organization that receives non-business receipts,

you will be required to account for GST on all services that you procure from overseas suppliers (“imported services”) as if you are the supplier, except for certain services which are specifically excluded from the scope of reverse charge.

You will be entitled to claim the corresponding GST as your input tax, subject to the normal input tax recovery rules.

The majority of businesses make taxable supplies and thus would not be affected by this reverse charge mechanism.

Taxing Business-to-Consumer (“B2C”) digital services by way of an overseas vendor registration regime

If you belong outside Singapore, you are required to register for GST in Singapore if you:

- have an annual global turnover exceeding $1 million; and

- make B2C supplies of digital services to customers in Singapore exceeding $100,000.

Once registered for GST, you are required to charge and account for GST on B2C supplies of digital services made to customers in Singapore.

If you are an electronic marketplace operator

Under certain conditions, whether you are a local or an overseas operator of an electronic marketplace, you may be regarded as the supplier of the digital services made by the overseas suppliers through your marketplace.

In such cases, you are required to include the value of these services to determine your GST registration liability. If you are liable for GST registration or are already GST-registered, you are required to charge and account for GST on B2C supplies of digital services made through your marketplace to customers in Singapore on behalf of the overseas suppliers, in addition to digital services made by you directly to customers in Singapore.

GST update – Supply of Digital Payment Tokens

With effect from 1 January 2020, the use/ provision of digital payment tokens as payment for anything (other than fiat currency or other digital payment tokens) is disregarded as a supply for GST purposes.

For GST purposes, the following supplies of digital payment tokens are treated as exempt supplies:

- Exchange of digital payment tokens for fiat currency or other digital payment tokens

- Provision of loans of digital payment tokens

In order to qualify as a digital payment token, the token must have all of the characteristics below:

- it is expressed as a unit;

- it is designed to be fungible;

- it is not denominated in any currency, and is not pegged by its issuer to any currency;

- it can be transferred, stored or traded electronically;

- it is, or is intended to be, a medium of exchange accepted by the public, or a section of the public, without any substantial restrictions on its use as consideration;

but does not include:

- money;

- anything which, if supplied, would be an exempt supply of financial services;

- anything which gives an entitlement to receive or to direct the supply of goods or services from a specific person or persons and ceases to function as a medium of exchange after the entitlement has been used.

Examples of digital payment tokens are Bitcoins, Ether, Litecoin, Dash, Monero, Ripple and Zcash.

Contact us today at [email protected] for a no-obligation GST consultation! See GST Services for more information about our services.