Singapore is one of the most business-friendly countries in the world, known for its strong regulatory environment, transparent legal framework, and efficient infrastructure. However, setting up a company in Singapore comes with statutory responsibilities that can be difficult to manage alone. That’s where a corporate secretary becomes essential.

Appointing a corporate secretary in Singapore is not just a legal requirement in Singapore—it’s a critical business decision. A good corporate secretary ensures your company complies with the Companies Act, manages board meetings, maintains key records, and liaises with authorities like ACRA. But more than that, they contribute to your company’s governance and long-term success.

The numbers speak volumes. The corporate secretarial services market across Singapore, Malaysia, and China reached US$1.85 billion in 2023. By 2032, experts predict this value will soar to US$3.24 billion. This 6.5% annual growth reflects a rising recognition: corporate secretaries drive business performance through governance excellence.

In this blog, we will learn about who can be a company secretary in Singapore, their qualifications, and, most importantly, the key benefits of hiring a corporate secretary in Singapore.

What is a Corporate Secretary in Singapore?

In Singapore, a corporate secretary ensures that a company complies with the law and maintains proper corporate governance. They manage essential filings, company records, board meetings, and communication between shareholders and directors. Their strategic and administrative role ensures your company runs smoothly and follows local regulations.

Every Singapore business must appoint a qualified corporate secretary who meets the government requirements, as the role carries significant responsibilities.

| Tip: Singapore companies must appoint a company secretary within 6 months of company incorporation. This position cannot be vacant for 6 months for the existing company.

Otherwise, you may incur a penalty of up to SGD 1,000. |

Who Can Be a Corporate Secretary in Singapore?

The six-month appointment deadline after incorporation marks a critical business milestone. Missing this deadline creates avoidable financial and legal exposure. Additional rules protect governance quality. According to ACRA (acra.gov.sg), a corporate secretary must:

- Be a natural person (not a company)

- Be ordinarily resident in Singapore

- Not be the sole director of the company (if it has only one)

Public companies require corporate secretaries with relevant professional qualifications.

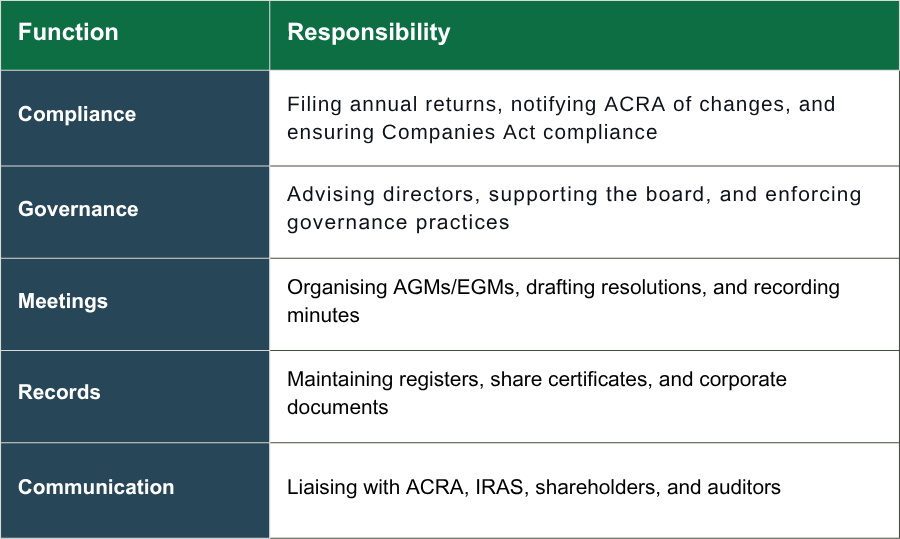

What Are the Responsibilities of a Corporate Secretary in Singapore?

A corporate secretary has many core administrative and fiduciary duties — these range from compliance with ACRA to organising key meetings to overseeing strategic business areas.

What Qualifications and Experience are required to be a corporate secretary in Singapore?

To be appointed as a company secretary in Singapore, the candidate must meet the following criteria as per the Companies Act, Section 171(1AA):

Private companies don’t require a professionally certified secretary, but experience is vital. For public companies, the secretary must have:

- Professional qualifications (e.g., ICSA, ISCA, or a practising lawyer)

- At least 3–5 years of relevant experience

- Deep knowledge of corporate law and regulatory compliance

What are the Benefits of Hiring a Corporate Secretary in Singapore?

In Singapore, the role of a corporate secretary is vital for ensuring smooth operations and legal compliance within a company. This position acts as a bridge between the board and regulatory bodies, safeguarding transparency and governance. Here are the key benefits of hiring a corporate secretary in Singapore:

1. Ensuring Compliance with Singapore Regulations

Singapore’s regulatory framework mandates that companies adhere to various legal requirements. A corporate secretary ensures your business stays compliant by:

- Filing annual returns with the Accounting and Corporate Regulatory Authority (ACRA)

- Maintaining statutory registers and records

- Organising Annual General Meetings (AGMS)

- Managing director and shareholder resolutions

Failure to comply can result in penalties or legal repercussions. A corporate secretary helps mitigate these risks by aligning your company with regulatory obligations.

2. Streamlining Administrative Tasks

Administrative responsibilities can be time-consuming and detract from your core business activities. A corporate secretary alleviates this burden by handling:

- Preparation and filing of statutory documents

- Maintenance of company records

- Coordination with government agencies

- Documentation of board meetings and resolutions

You can focus on strategic growth and operations by entrusting these tasks to a professional.

3. Enhancing Corporate Governance

Good corporate governance is vital for building stakeholder trust and ensuring long-term success. A corporate secretary contributes by:

- Advising the board on governance best practices

- Ensuring transparency in decision-making processes

- Facilitating effective communication between the board and shareholders

- Implementing ethical business practices

Their expertise supports a robust governance framework, enhancing your company’s reputation and credibility.

4. Providing Strategic Business Insights

Beyond administrative duties, a corporate secretary offers valuable insights into your company’s operations. They can:

- Identify areas for operational improvement

- Advise on corporate restructuring and expansion

- Support strategic decision-making processes

- Ensure alignment with regulatory changes

Their comprehensive understanding of corporate compliance and governance makes them a strategic asset to your business.

5. Managing Stakeholder Relations

Effective communication with stakeholders is crucial for business success. A corporate secretary facilitates this by:

- Serving as a liaison between the company and shareholders

- Coordinating with auditors and legal advisors

- Managing relationships with regulatory bodies

- Ensuring the timely dissemination of company information

A corporate secretary helps foster trust and confidence in your company by maintaining positive stakeholder relations.

How to Choose the Right Corporate Secretary in Singapore?

Choosing the right corporate secretary impacts your company’s success. Here’s how to select the best one:

1. Start with Legal and Regulatory Requirements

Ensure the secretary meets Singapore Companies Act requirements:

- Must be a natural person

- Ordinarily resident in Singapore

- Not disqualified under the Act

- Cannot be the sole director of the company

2. Check for Relevant Qualifications and Experience

Look for professional certifications like ICSA or ISCA. Industry-specific experience adds value.

3. Assess Understanding of Local Regulations

Choose someone familiar with Singapore’s legal framework, including tax and compliance issues. Their knowledge ensures your company stays compliant and forward-thinking.

4. Evaluate Organisational Skills

A good corporate secretary must juggle multiple tasks—record keeping, meeting scheduling, and document filing—without errors or delays.

5. Consider Communication Skills

They are the main link between your board, shareholders, and regulators. Clear, concise communication is essential.

6. Look for Strategic Thinking

The best secretaries go beyond admin—they provide insights that align with your company’s goals and long-term plans.

7. Determine Cultural Fit

They should blend well with your team, uphold your values, and support your vision.

8. Check References

Speak to past employers or clients to learn about their reliability, professionalism, and ethics.

9. Trust and Discretion

Since they handle sensitive data, discretion is crucial. Trust is non-negotiable in this role.

Conclusion

A corporate secretary in Singapore is crucial in keeping your business compliant and well-governed. But beyond fulfilling legal obligations, the right corporate secretary can become a strategic asset, enhancing governance, reducing risk, and helping you stay one step ahead in a competitive market.

At 3E Accounting, we take pride in offering award-winning corporate secretarial services in Singapore tailored for all types of businesses. Our team combines experience, local regulatory expertise, and a proactive approach to ensure your company remains fully compliant, so you can focus on growing your business.

Ready to simplify compliance and strengthen your business governance?

Contact 3E Accounting today and let our experts handle the details while you drive success.

Hiring a company secretary in Singapore?

Hiring a corporate secretary is a legal must and a smart move for your Singapore business. Choose the right one with 3E Accounting today.

Frequently Asked Questions

Yes, it’s a legal requirement to appoint a corporate secretary in Singapore within 6 months of incorporation.

No, a corporate secretary in Singapore must be ordinarily resident, such as a citizen, permanent resident, or valid work pass holder living locally.

Only if the company has more than one director. A sole director cannot also act as the corporate secretary in Singapore.

They maintain statutory registers (such as the Registrar of Company Officers), prepare board minutes, AGMs, official correspondence and more duties as assigned by the directors. They also track changes in the organisation and report them to ACRA.

Failure to appoint a corporate secretary in Singapore can lead to penalties and non-compliance issues with ACRA.

Abigail Yu

Author

Abigail Yu oversees executive leadership at 3E Accounting Group, leading operations, IT solutions, public relations, and digital marketing to drive business success. She holds an honors degree in Communication and New Media from the National University of Singapore and is highly skilled in crisis management, financial communication, and corporate communications.