In the pursuit of expanding your business and securing its long-term success, every decision you make plays a crucial role. One of the most important decisions is choosing the right business structure. For many entrepreneurs, a sole proprietorship or Limited Liability Partnership (LLP) might have been the starting point, offering simplicity and control. However, as your business grows and evolves, so too should your business structure.

Converting your sole proprietorship or LLP into a Private Limited Company (Pte Ltd) is a pivotal step that can open doors to new opportunities. It provides your business with limited liability protection, greater credibility, access to corporate tax benefits, and a wider range of funding options. In a competitive and dynamic business environment like Singapore, transitioning to a Pte Ltd can be the catalyst for growth and sustainability.

This blog will guide you through why this conversion is critical, the key differences between business structures, and the step-by-step process for successfully transitioning to a Pte Ltd company.

Why Convert to a Private Limited Company (Pte Ltd)?

Converting your sole proprietorship or LLP to a Private Limited Company (Pte Ltd) in Singapore offers numerous advantages that can significantly boost your business. Here are the key reasons for making the switch:

- Limited Liability Protection

As a separate legal entity, a Pte Ltd shields your personal assets from business liabilities, limiting your risk to the capital invested. - Corporate Tax Benefits

Pte Ltd companies enjoy lower corporate tax rates and exclusive tax incentives, including exemptions on the first S$200,000 of income. - Enhanced Credibility

A Pte Ltd company is seen as more trustworthy and credible by clients, investors, and business partners, making it easier to establish strong business relationships. - Better Access to Funding

Raising capital is easier as Pte Ltd companies can attract investors, venture capital, and bank loans due to their limited liability and structured governance. - Perpetual Succession

Unlike sole proprietorships, a Pte Ltd has perpetual succession, ensuring the business continues beyond the retirement or departure of shareholders. - Attracting Top Talent

Pte Ltd companies offer better job security and benefits, making it easier to attract high-quality employees.

By converting to a Pte Ltd, you protect your personal assets, benefit from tax savings, and open the door to expansion opportunities.

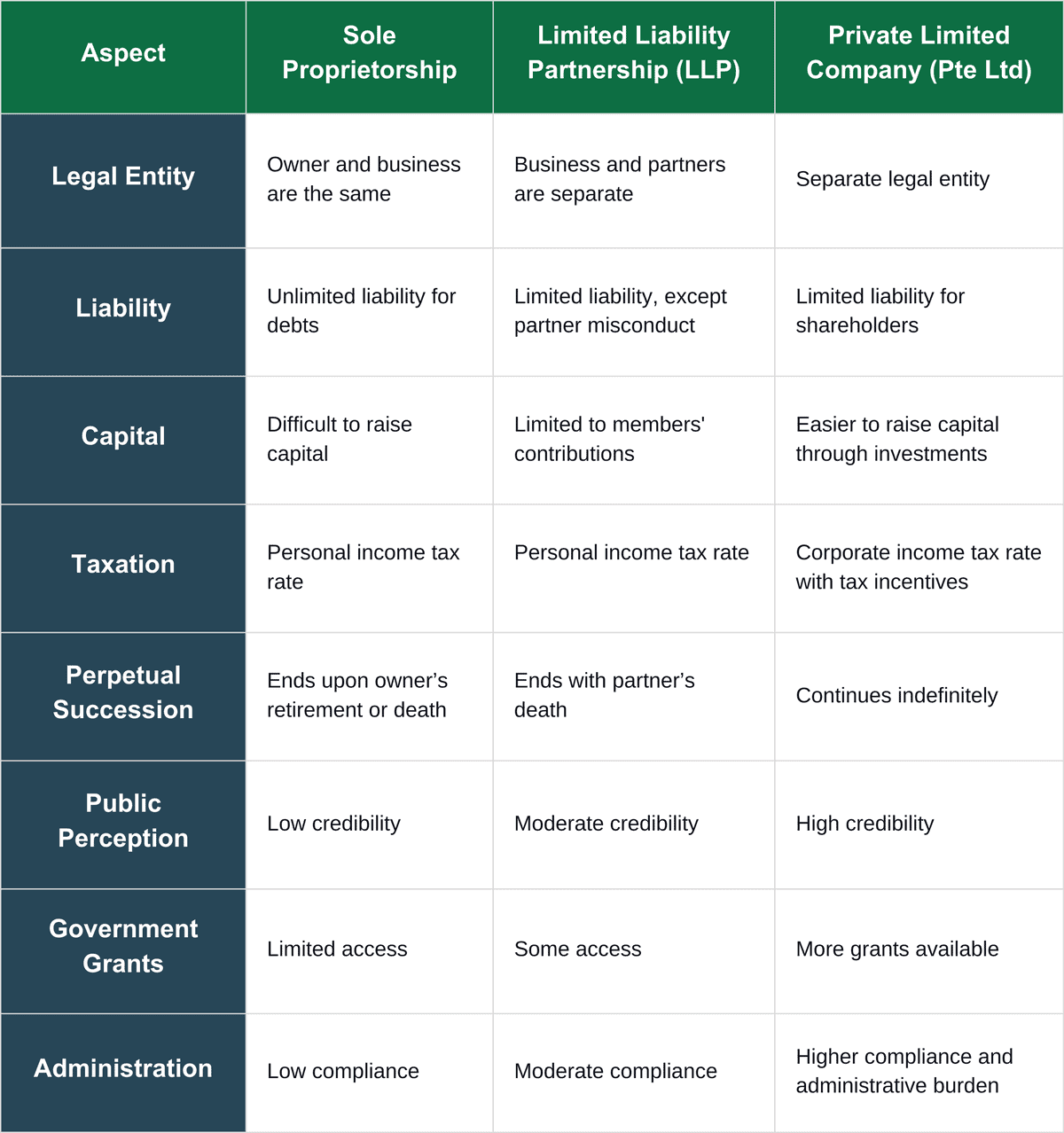

Differences Between Sole Proprietorship, LLP, and Pte Ltd

To make an informed decision about converting your business, it is crucial to understand the key differences between sole proprietorships, LLPs, and Pte Ltd companies:

Steps to Convert a Sole Proprietorship or LLP to a Pte Ltd in Singapore

Converting your sole proprietorship or Limited Liability Partnership (LLP) to a Private Limited Company (Pte Ltd) involves a clear set of procedures. This transition is beneficial for business growth but must be handled carefully to ensure all legal and administrative requirements are met. Below are the key steps to guide you through the conversion process:

Step 1: Incorporate a New Private Limited Company

The first action is to register a new Pte Ltd company under the Singapore Companies Act with the Accounting and Corporate Regulatory Authority (ACRA). The process involves the following:

- Business Name Approval: Your first task is to secure approval for a new business name. Singapore law mandates that no two companies can have the same name. If you wish to keep your current business name, you’ll need to submit a “No Objection Letter” to ACRA. This letter must explain your intent to retain the old name and show that both the existing and new entities belong to the same owner.

- Company Incorporation: After name approval, proceed with the incorporation by filing the necessary documents such as the company constitution, shareholder and director details, and the registered office address. It’s also important to declare that the new Pte Ltd will take over the operations of the current sole proprietorship or LLP. Once incorporated, the new company will officially exist as a separate legal entity.

- Cessation of Old Business: Following the incorporation, the old business must cease operations within three months to ensure compliance. This avoids overlapping between the two entities and ensures a smooth transition to the new structure.

Step 2: Transfer Business Assets and Contracts

Once the Pte Ltd is incorporated, the next step involves transferring all assets, contracts, and business operations from the sole proprietorship or LLP to the new Pte Ltd. Here’s what needs to be done:

- Business Assets: The assets from the sole proprietorship or LLP can be transferred to the Pte Ltd and may be treated as paid-up capital. Before transferring, any outstanding debts must be settled, and agreements must be made on how the assets will be allocated to the new entity.

- Bank Accounts: Close any bank accounts that were in the name of the old entity and open new ones under the Pte Ltd company’s name. Notify clients, suppliers, and other stakeholders of the change in banking details.

- Leases and Contracts: Any lease agreements, service contracts, or other legal obligations under the sole proprietorship or LLP must be reassigned and re-signed under the new Pte Ltd. This ensures that the business can continue operations without any disruptions.

- Permits and Licences: Reapply for necessary business licences and permits under the name of the new Pte Ltd company. Most licences are not transferable, so fresh applications will be required to ensure compliance.

- GST Registration: If your old business is registered for GST (Goods and Services Tax), you will need to cancel the old registration and apply for new GST registration under the Pte Ltd. This allows the company to continue its tax obligations and business transactions without any issues.

- MOM/CPF Accounts: Transfer existing employee records, especially those related to the Ministry of Manpower (MOM) and Central Provident Fund (CPF) contributions, to the new Pte Ltd. Relevant forms must be submitted to ensure that employees’ payroll and benefits remain uninterrupted.

Step 3: Terminate the Sole Proprietorship or LLP

After transferring all business operations and assets, you must formally terminate the old entity. This is the final step in completing the transition to a Pte Ltd.

- Sole Proprietorship: You will need to submit a “Notice of Cessation” to ACRA to officially close the sole proprietorship. This must be done within three months from the incorporation of the new Pte Ltd company.

- LLP: If you are converting from an LLP, there are two ways to end the business: either by striking off or winding up the LLP. Striking off is generally recommended as it is a simpler and quicker process. Winding up is more complex and typically used when the LLP has significant ongoing obligations that need to be resolved.

Conclusion

Converting your sole proprietorship or LLP into a Pte Ltd company is a strategic move for any growing business. The shift offers enhanced protection, tax benefits, and the flexibility to scale. However, the conversion process can be complex, requiring thorough planning and careful execution. By following the steps outlined above, you can ensure a smooth transition.

At 3E Accounting Pte Ltd, we are here to help you navigate this transition and make it as seamless as possible. With our expertise in business incorporation, we’ll handle all the paperwork and administrative tasks, allowing you to focus on what matters—growing your business.

Ready to take your business to the next level?

Convert your sole proprietorship or LLP to a Private Limited Company with 3E Accounting’s expert guidance.

Contact Us TodayFrequently Asked Questions

In Singapore, both sole proprietorships and LLPs are taxed based on personal income tax rates. The business profits are considered part of the owner’s or partners' personal income. In contrast, a Private Limited Company (Pte Ltd) is subject to corporate tax rates and may qualify for specific tax exemptions and rebates, offering potential tax savings.

Sole proprietorships typically face significant challenges in raising capital, often relying on the owner’s personal savings or reinvesting business profits. Securing external financing, such as loans, can be difficult, as lenders may require the use of personal assets as collateral. LLPs also face hurdles in raising capital externally, but a Private Limited Company (Pte Ltd) has more options, including issuing shares to investors, attracting venture capital, and securing business loans, which makes funding more accessible for expansion.

In a sole proprietorship, the owner is personally liable for all business debts and obligations since there is no legal distinction between the owner and the business. This means that if the business incurs debts or losses, the owner’s personal assets can be at risk to cover those liabilities.

Abigail Yu

Author

Abigail Yu oversees executive leadership at 3E Accounting Group, leading operations, IT solutions, public relations, and digital marketing to drive business success. She holds an honors degree in Communication and New Media from the National University of Singapore and is highly skilled in crisis management, financial communication, and corporate communications.