Innovative Approach to Medical Cost & Technology – 3E Accounting

Covid-19 has given new meaning to the axiom of “Health is Wealth”. One of the key pillars of the Singapore healthcare system would be Medishield Life. Medishield Life is a key clog in the machinery which made Singapore work and where serious illness doesn’t bankrupt the entire family. Therefore, it is good news that the Singapore Government is looking to increase Medishield Life’s yearly claims from $100,000 to $150,000 in 2021.

As a trade-off, premiums would increase by up to 35%. 3E Accounting supports the government’s proactive approach to managing healthcare cost and quality in Singapore. 3E Accounting also encourages its employees to stay healthy with work-life balance and provide them with the necessary funds to cover their health insurance premiums.

The 3E Medical Care Approach

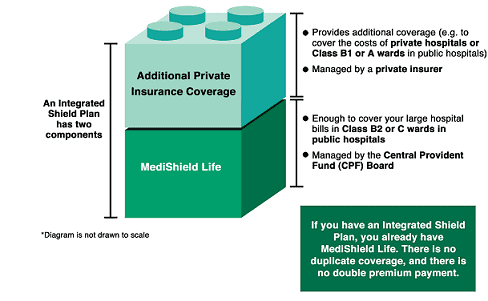

3E Accounting believes that a healthy workforce is key for business success. As a caring employer, 3E reimburses the hospitalization insurance premiums of any employees who had at least three consecutive months of service with the firm. Our employees are encouraged to enhance their Medishield Life coverage with any of the 7 private hospitalization insurers (Income, AIA, Great Eastern, Prudential, Aviva, AXA, Raffles Health) in the market to form an Integrated Shield Plan (ISP).

Source: Singapore’s Ministry of Health

They can leverage on the Annual Withdrawal Limits between $300 to $900 from their Medisave to pay for their insurance premium. Over and beyond that withdrawal limit, especially for private insurer’s rider plans, they will have to pay cash. 3E Accounting commits to reimburse them according to the grade of their job.

| Job Grade (3E Accounting) | Hospital Insurance Claim |

| 1 | Maximum of S$600 per calendar year |

| 2 | Maximum of S$650 per calendar year |

| 3 | Maximum of S$700 per calendar year |

| 4 | Maximum of S$750 per calendar year |

| 5 | Maximum of S$800 per calendar year |

| 6 | Maximum of S$850 per calendar year |

| 7 | Maximum of S$900 per calendar year |

3E Accounting is cognizant that only 2 insurers (AIA & Aviva) provide additional critical illness coverage from their ISP. Therefore, employees are further encouraged to purchase additional term or life insurance policies that provide coverage for death, critical illness and permanent disability with a minimum coverage of $100,000.

| Job Grade (3E Accounting) | Insurance Claim for Insurance Policy Covering Death, Critical Illness & Permanent Disability |

| 1 | Maximum of S$500 per calendar year |

| 2 | Maximum of S$600 per calendar year |

| 3 | Maximum of S$700 per calendar year |

| 4 | Maximum of S$800 per calendar year |

| 5 | Maximum of S$900 per calendar year |

| 6 | Maximum of S$1050 per calendar year |

| 7 | Maximum of S$1100 per calendar year |

These are generous reimbursements which would cover the lion’s share of our employee’s health insurance cost.

Supporting Medical Technology

3E Accounting has always been at the forefront of technology as seen in our Double Robotics project. Even as the Singapore government is proactively enhancing the security of our healthcare system, the public sector should also leverage technology to enhance public access to health care. 3E Accounting believes that the future of healthcare should include the following:

1. Teleconsultation

Before covid, teleconsultation was seen as a convenience, but they are now an essential part of public health safety. Innovative medical start-ups should have built-in doctor teleconsultations in their apps and make them available for the general public – whether they are members or not.

2. Built-In Artificial Intelligence for Medical Imagery

MRIs and X-rays take a disproportionate amount of time (minimum 1 week) and cost (at least S$80) to read and interpret which drives up medical cost and creates unnecessary anxiety for the patient and their family. The next generation of a start-up should use AI for image recognition and have predictive algorithms to read MRIs and X-rays.

3. Lower Cost & Pre-consultation Price Estimate

Technology has been known to lower the cost of electronic products. For the same amount of $1000, we can get better phones and televisions year after year. For technology-enabled medical care, medical consultation cost should be slashed by 50%. Before even going to see the doctor, technology should provide an estimate of the cost to promote transparency and clarity.

Overall, technology should lower cost and provide better outcomes for all patients and have a wide network with physicians and medical institutions on their app.

The island of Stability for Healthcare

Instead of company insurance, 3E Accounting expects our employees to take personal responsibility for their health and the best option would be ISP. ISP covers our employees for a lifetime even if they were to leave us one day. We do not encourage our employees to switch plans if their current plan covers their pre-existing condition.

Singapore is generally a place where everything works so that you can focus on your career, family time and interests. This stability attracted billions of dollars from Multi-National Companies (MNC) to set up an operational base in Singapore. This pandemic helped MNCs to realize that Singapore is also an island of stability for healthcare, in addition to its strength of political stability and geographic advantage.

3E Accounting is grateful to the competent Singapore government, past and present, which made Singapore the best place in the world to live and realize our dreams.